Portfolio weight calculator

To compute the portfolio weight of each investment repeat the calculation in successive cells dividing by the value in cell A2. Finally calculate the Portfolio Weight.

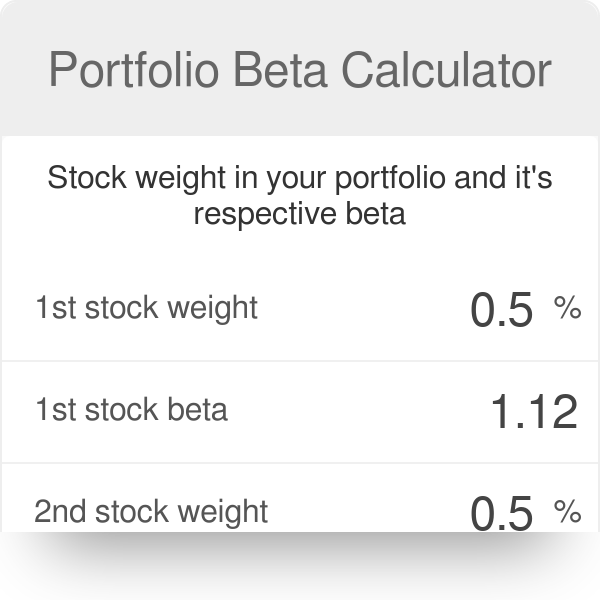

Portfolio Beta Calculator

First determine the value of the given asset.

. 2 Find the Root funds and the corresponding base funds. Our asset allocation tool shows you suggested portfolio breakdowns based on the risk profile that you choose. Next determine the value of the entire portfolio.

For calculation of the portfolio weight in an investment portfolio based on the number of units you have to simply divide the number of units of a specific asset by the total number of units of. Multiple parent funds holding position in same child fund works in. To print out the weight for each of the base funds.

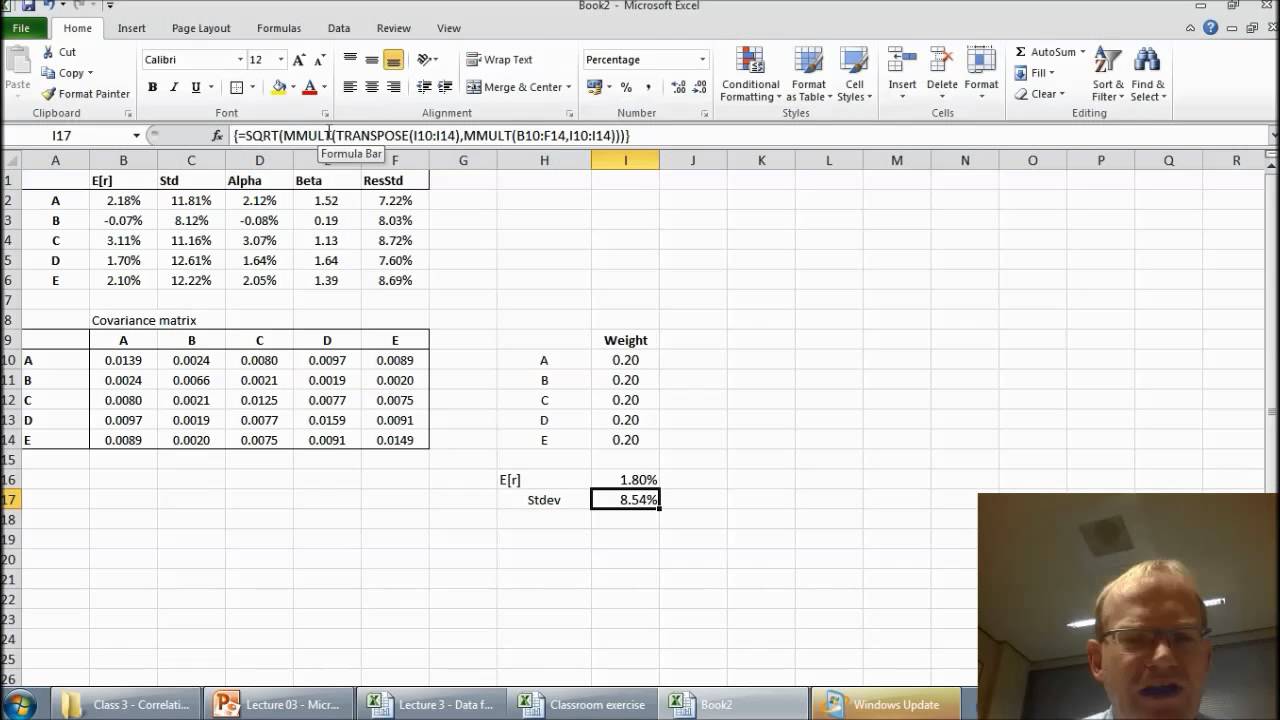

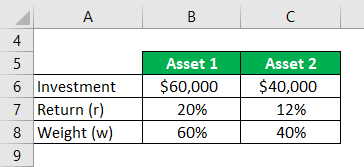

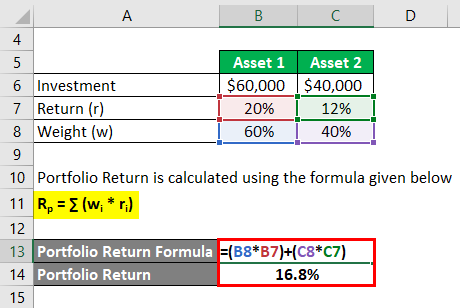

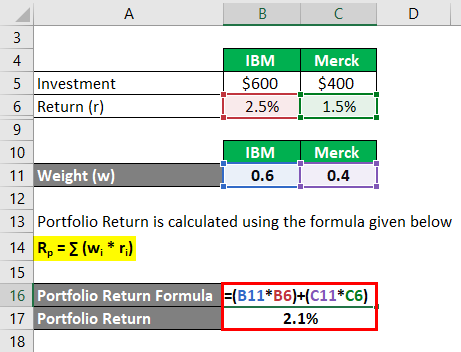

The required inputs for the optimization include the time range and the portfolio assets. Portfolio Return is calculated using the formula given below Rp wi ri Portfolio Return 0267 18 0333 12 0400 10 Portfolio Return 128 So the overall outcome. We have three different funds in our portfolio each having a different expense ratio and a different fund position.

The weightage of the respective assets in the portfolio the standard deviation of those assets as well as the covariance of. Flattened fund structure and market value is provided as input. Armed with the above information you can calculate the.

Next gather the formula from above PW AV P 100. Calculating Portfolio Weight To get the market value of a stock position multiply the share price by the number of shares outstanding. Now for the calculation of portfolio return we need to multiply.

The following steps outline how to calculate the Portfolio Weight. Similarly we have calculated the weight for other particulars as well. Simply divide each of your stock positions cash value by your total portfolio value and then multiply by 100 to convert to a percentage.

You can also use the Black-Litterman model based. Therefore portfolio risk calculation includes three main variables. This calculator calculates fund weight for all base leaf node funds within the portfolio.

Weight XYZ Stock 100000 620000 01613. Contribute to govorunovweight_calculator development by creating an account on GitHub. W1 and W2 are the percentage of.

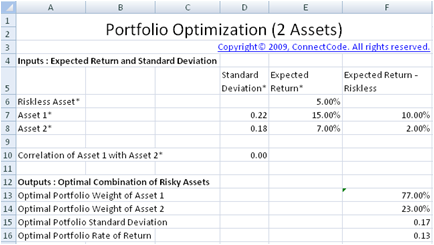

The calculation is simple enough. The Two Asset Portfolio Calculator can be used to find the Expected Return Variance and Standard Deviation for portfolios formed from two assets. The Two Asset Portfolio Calculator can be used to find the Expected Return Variance and Standard Deviation for portfolios formed from two assets.

Put the formula C2 A2 in cell E2. Using the above formulas we then calculate the portfolio expected. If Apple is trading at 100 and 548.

We use historical returns and standard deviations of stocks bonds and cash to. Fund weight for B and C in fund A is 033 and 067 respectively. Portfolio asset weights and constraints are optional.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. To compute the portfolio weight of each investment repeat the calculation in successive cells dividing by the value in cell A2. We start with a brief beta definition in stock market context.

As mentioned in the beta calculator the beta of a stock or the beta of a portfolio is a value that measures the extra. To construct a portfolio frontier we first assign values for ER 1 ER 2 stdevR 1 stdevR 2 and ρR 1 R 2. This program can calculate fund weight within a portfolio.

Contribute to youngf-GitHubPortfolio-Weight-Calculator development by creating an account on GitHub.

Optimization Formula For Optimal Portfolio Of 2 Assets When No Shorting Allowed Quantitative Finance Stack Exchange

Optimal Portfolios With Excel Solver Youtube

Finance Problem Determining Portfolio Weights Youtube

How To Calculate Your Portfolio S Beta Weighted Delta Aussie Stock Forums

Investments Portfolio Weights And Portfolio Optimization Cfajournal

Portfolio Return Formula Calculator Examples With Excel Template

Portfolio Return Formula Calculator Examples With Excel Template

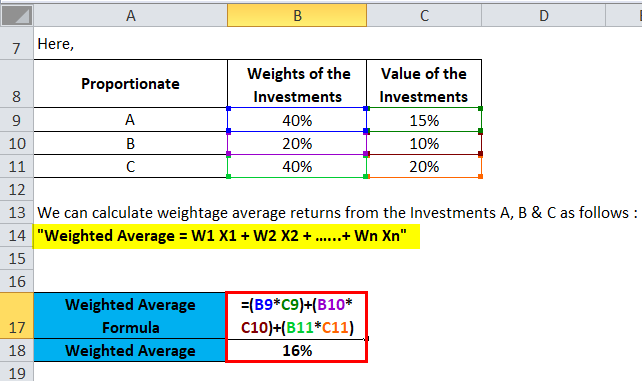

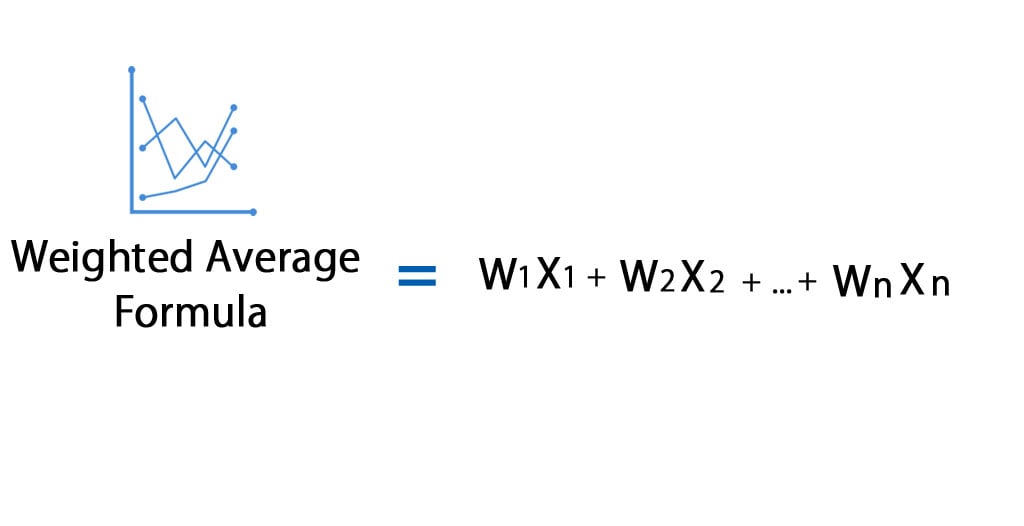

Weighted Average Formula Calculator Excel Template

2

Calculating A Sharpe Optimal Portfolio With Excel

Calculating A Sharpe Optimal Portfolio With Excel

Portfolio Beta Calculator Marketxls

Portfolio Return Formula Calculator Examples With Excel Template

Portfolio Return Formula Calculate The Return Of Total Portfolio Example

Free Portfolio Optimization

Portfolio Return Formula Calculator Examples With Excel Template

Weighted Average Formula Calculator Excel Template